Medical insurance is a specific type of insurance that is used to cover the complete or partial cost of someone’s medical expenses. These expenses can range from surgeries, to hospital expenses, to even prescriptions. An insurer needs to determine the risk level of someone by assessing the risk factors of them developing a health complication in the future.

This is mostly done with an assessment of someone’s family and medical history, along with an analysis of a person’s environment and lifestyle. After completing a full and proper assessment an insurer will then provide the person with the appropriate medical insurance. One that hopefully benefits both parties.

What is Medical Insurance?

Medical insurance is an incredibly useful tool of recent history. This is because in most cases patients without medical insurance end up having to spend a significant portion of their income on medical expenses.

In cases where the disease is a constant through someone’s life, this can prove to be even more costly. For example, someone who has been diagnosed with Type 1 Diabetes would need a constant supply of insulin in order to maintain a particular standard of living.

However, especially in the United States, insulin is very expensive. Therefore, the only hope for a regular citizen, diagnosed with this disease is, medical insurance.

But in some cases, people are unable to find the appropriate resources to gain medical insurance. For example, majorly the only reason why a person even has medical insurance, to begin with, is because of the company policy of the organisation that either where they work at or where their spouse works.

In a lot of instances, children are not covered in medical insurance, or dental work is not covered in a company’s medical insurance policy. Therefore, proving it to be very difficult for the common man to find ways to get the proper medical treatment they need.

Generally, the companies with extensive medical insurance policies are the ones that are mostly large and profitable multinational corporations that have a large employee pool and a constant stream of profit. However, not everyone works at an MNC and not every company can afford to provide their employees with extensive medical insurance plans.

Medical Treatment Without Medical Insurance

So now the question that we have is how much does it cost to get a proper treatment done without medical insurance?

Following the above-mentioned example, let’s assume that we are observing a patient who has Type 1 Diabetes throughout their adult life and they need a constant stream of insulin in order to survive and maintain a decent standard of living. We are already aware of the side effects that come with diabetes, such as the possibility of amputation, lethargy, weight loss, and other increases in risk factors.

Insulin without medical insurance can also vary. For example, the older insulin vials range from $25 to $100. The newer ones cost as much as $174 and can go up to $300 depending on the type of vial you use. Other than the vials themselves you would also need to purchase syringes, that you cannot reuse, these cost an average of $20 in a box that contains around 100 syringes.

You would also need test strips, an average box ranges around $25 to $60 and has about 50 test strips. You might need to use 1 to 10 strips a day. One would also require an insulin pump which can cost around $6000 along with $300 for additional supplies, such as batteries.

Moreover, there has been a rise in the cost of insulin as is, and some medical insurance plans no longer cover insulin, or only cover a part of it.

Bottom Line: it is expensive to be a diabetic in this world.

Methods to Keep Lab Test Costs Low Without Insurance

Although the picture presented above might seem bleak and dreadful, there is still hope. You can still find methods in order to reduce the cost of your medical expenses and find ways to ensure that you do not break the bank every time that you go to the pharmacy.

One such method is the new wave of telehealth facilities that are becoming radically available. Facilities such as remote consultations and lab tests that are affordable are available readily around the world.

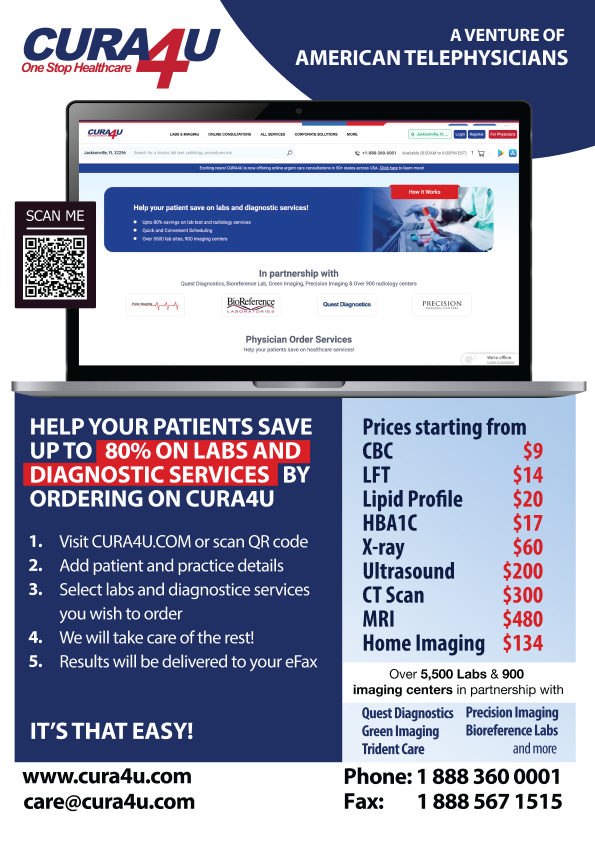

One such example is Cura4U. A completely remote and computerised telehealth facility that allows patients to get first-class treatment without needing to break the bank. A patient can get a virtual consultation for even their dental checkups, something that is not covered in most medical insurance policies.

One can even use Cura4U’s blogs to get general medical advice and tips to stay healthy especially in these trying times. What once started off as a need due to the pandemic has now become a necessity even in a world where the pandemic will hopefully cease to exist.

Therefore, there is still hope for the regular individual to get the treatment that they need, even without medical insurance!