In the midst of navigating healthcare options, small business owners often find themselves at a crossroads, striving to offer the best healthcare solutions to their employees without compromising on cost-effectiveness and quality. The Small Business Health Options Program (SHOP) emerges as a beacon of hope, offering tailored healthcare plans designed for the unique needs of small enterprises. With an emphasis on affordability, accessibility, and comprehensive coverage, SHOP, in partnership with healthcare innovators like CURA4U, is revolutionizing healthcare for small businesses.

Understanding the SHOP Program: A Foundation for Small Business Healthcare

At its core, the SHOP program is engineered to empower small business owners to provide healthcare options that are both affordable and comprehensive. It underlines the essential eligibility criteria, making healthcare accessible to businesses with a modest number of employees. This initiative not only supports the wellbeing of the workforce but also enhances the overall productivity and morale of the team, laying the groundwork for sustained business growth.

Demystifying How SHOP Works with CURA4U: A Step-by-Step Exploration

To make the process of enrolling in SHOP through CURA4U smooth and intuitive, let's break down the steps:

-

Service Booking and Order Slip Generation: CURA4U streamlines the initial step by facilitating easy booking of the required healthcare services. Upon booking, you'll immediately receive an order slip, indicating the initiation of your healthcare plan activation.

-

Sampling at Quest Diagnostics: Recognizing the importance of convenience and accuracy, CURA4U partners with Quest Diagnostics for sampling. This partnership ensures that employees can easily visit their nearest Quest location to complete any necessary tests or samplings without hassle.

-

Online Delivery of Results: In today's digital age, speed and privacy are paramount. Hence, results from tests are securely delivered online, allowing for swift, confidential access to crucial health information.

-

Consultations with CURA4U Physicians: Finalizing the process, CURA4U offers professional consultations with physicians who specialize in discussing and deciphering lab results. This critical step ensures employees not only understand their health status but also receive guidance on next steps, fostering a culture of informed health decisions.

5 things to look at when selecting a health Care plan as a small business

Selecting the ideal health plan for a small business on a cash-based system is crucial for ensuring that employees receive comprehensive healthcare benefits while keeping expenditures manageable. Here are five key points to consider when selecting an ideal cash-based health plan for small businesses:

-

Cost-Effectiveness: A paramount consideration for small businesses is finding a plan that fits within their budgetary constraints without sacrificing the quality of care. Cash-based plans can often bypass traditional insurance markups, offering more affordable rates for medical services. Assess the plan for transparency in pricing to ensure that the healthcare expenses are predictable and offer significant savings compared to insurance-based models.

-

Coverage Scope: Evaluate what types of healthcare services are covered under the plan. An ideal cash-based health plan should include a wide range of services from preventive care, such as annual check-ups and screenings, to diagnostic tests and specialist consultations. The scope of coverage is crucial in ensuring employees have access to comprehensive healthcare services when needed.

-

Network of Providers: Look into the network of healthcare providers and facilities affiliated with the plan. A robust network that includes a wide selection of doctors, specialists, and healthcare facilities ensures that employees have easy access to medical care without long waiting periods. Also, consider whether the plan offers telehealth services for added convenience.

-

Flexibility and Convenience: Small businesses benefit from health plans that offer flexibility in terms of payment, services, and care options. Plans that allow for personalized healthcare solutions, such as adding or removing services based on specific needs or allowing employees to use services without complex referral processes, can be incredibly advantageous. Additionally, features such as online appointment bookings and direct access to healthcare providers can enhance the overall experience.

-

Health Savings Account (HSA) Compatibility: If possible, opt for a health plan that is compatible with Health Savings Accounts (HSAs). Even in a cash-based structure, HSAs can offer employees a way to save for medical expenses tax-free, providing an additional financial buffer. This can be especially beneficial in complementing the cash-based plan by covering costs that may not be included, such as prescription medications or services beyond the plan's scope.

By carefully considering these points, small businesses can select a cash-based health plan that not only meets the healthcare needs of their employees but also aligns with the company's financial health and values.

CURA4U: Redefining Small Business Healthcare Solutions

Choosing the right health plan through SHOP requires consideration of several crucial factors, with CURA4U's offerings standing out for their depth and comprehensiveness:

What is Cura4U?

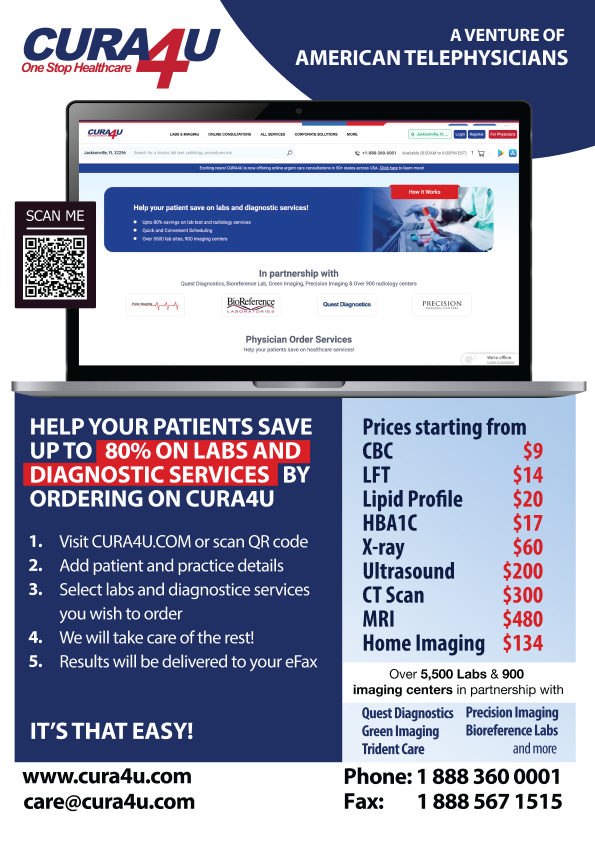

CURA4U is a health technology platform that aims to simplify access to healthcare services for individuals and businesses. It offers a range of services that may include booking doctor appointments, health screenings, diagnostic tests, and telehealth consultations, often at negotiated rates. For businesses, including small enterprises, CURA4U provides tailored health plan solutions that align with specific organizational needs, focusing on affordability and accessibility. .

CURA4U’s mission is to bridge the gap between small businesses and accessible, quality healthcare. By aligning with the SHOP program, CURA4U offers cash-based, no-insurance-necessary plans that resonate with the ethos of small business operations. This innovative approach ensures that healthcare is not just an added benefit but a core component of a small business's offering to its employees, promoting a healthy, happy, and productive workplace.

Here is how Cura4U helps:

-

Comprehensive Health Check-ups: Through CURA4U, businesses can access health plans that include detailed consultations and essential tests conducted at Quest Diagnostics. This offering is pivotal in preventive health care, ensuring early detection and management of potential health issues.

-

Comprehensive Lab Testing: Plans cover a wide range of necessary tests, such as Complete Blood Count (CBC), Comprehensive Metabolic Panel, Lipid Profile, and Urinalysis. These tests are instrumental in painting a full picture of an employee's health, encouraging a proactive approach to health management.

Conclusion: Embrace a Healthier Future with CURA4U and SHOP

In conclusion, the collaboration between SHOP and CURA4U presents a groundbreaking opportunity for small businesses to redefine the landscape of employee healthcare benefits. By offering tailored, cost-effective, and comprehensive healthcare plans, small business owners can now ensure their teams have access to the quality healthcare they deserve. It’s a call to action for small business owners to explore the offerings of CURA4U as part of the SHOP program, paving the way for a healthier, more resilient future for both their employees and their business.

In a world where healthcare options can often seem daunting and inaccessible, CURA4U stands out as a beacon of hope, committed to demystifying and simplifying healthcare for small businesses across the nation. Join us in this health revolution and take the first step towards securing a brighter, healthier future for your team today.