In today's dynamic business landscape, small businesses face the challenge of providing quality health plans for their employees while navigating the complexities of the Affordable Care Act (ACA). This landmark legislation has reshaped the healthcare industry, particularly affecting how small businesses approach their employee benefits strategies. Let's delve into how the ACA has impacted small business health plans, focusing on innovative solutions like cash-based plans offered by Cura4U.

Employer Mandate and Small Businesses

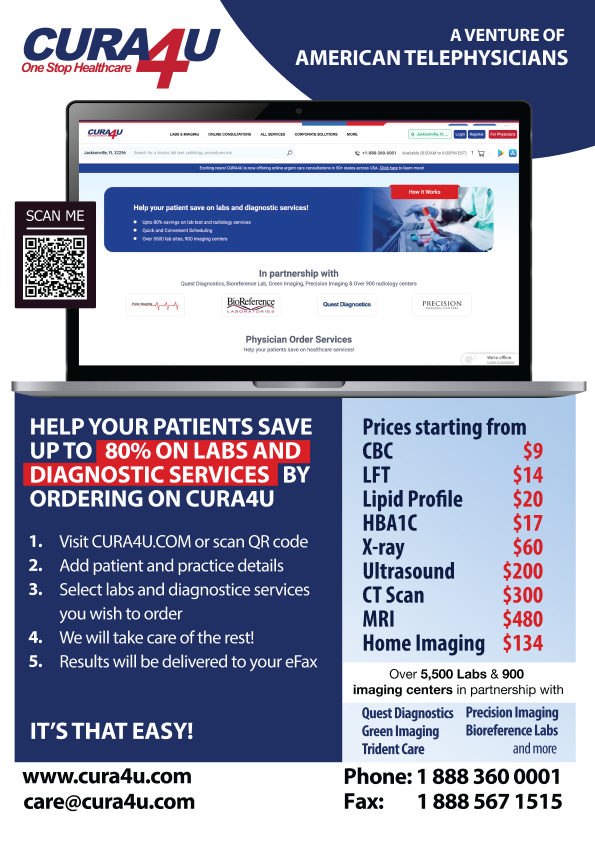

The ACA's Employer Mandate imposes certain requirements on small businesses regarding health insurance coverage for their employees. However, for small businesses that may not be able to afford traditional insurance plans, alternative options like cash-based health plans provided by companies such as Cura4U offer a flexible and cost-effective solution.

Small Business Health Plan Options

While traditional insurance plans are commonly used, cash-based health plans like those offered by Cura4U present a unique choice for small businesses seeking accessible and affordable healthcare benefits. These plans provide businesses with the flexibility to design customized healthcare coverage without the complexities associated with insurance carriers.

Premium Impacts for Small Businesses

By opting for cash-based health plans, small businesses can potentially reduce premium costs and administrative overhead compared to traditional insurance plans. Cura4U's cash-based approach allows businesses to manage their healthcare expenses more efficiently, leading to potential savings that can be reinvested in other areas of the business.

Administrative Costs for Small Businesses

Cash-based health plans, such as those provided by Cura4U, offer a streamlined and transparent process for accessing healthcare services. This simplicity not only benefits employees by facilitating quick and direct payments for healthcare services but also helps small businesses minimize administrative costs associated with complex insurance claims processes.

Employee Recruitment and Retention for Small Businesses

Cura4U's cash-based small business health plans can be a valuable asset in employee recruitment and retention strategies. By offering a straightforward and cost-effective healthcare benefits package, small businesses can enhance their employee value proposition and attract top talent while promoting employee well-being and loyalty.

Compliance Strategies for Small Business Health Plans

The Affordable Care Act (ACA) has a significant impact on small businesses, and navigating ACA compliance is essential for these organizations.Innovative solutions like Cura4U's cash-based health plans can help businesses meet their regulatory obligations while also optimizing their healthcare benefits strategy.By incorporating cash-based options into their benefits offerings, small businesses can achieve compliance and cost-effectiveness simultaneously.

Here are some of the key ACA requirements that small businesses must comply with:

By incorporating the details of Cura4U's cash-based small business health plans into the discussion of small business health plans under the ACA, small business owners can gain insight into alternative solutions that align with their financial constraints and priorities. Through innovative approaches like those offered by Cura4U, small businesses can navigate the evolving landscape of healthcare benefits with confidence and efficiency.